Many people assume buying a house is a “good investment”. Being a real estate agent in Kansas City, I tend to agree. People often assume any money they “put into” their house is a good investment. However, that’s not necessarily the case. Remodeling and upgrading is great for your use and enjoyment, but don’t expect to get your money back when you sell. Especially if you sell soon after making major home improvements.

The Myth vs. Reality

Despite what they show on HGTV, spending money on maintenance and/or improvements rarely increases the resale value by as much as you spent. There are several reasons for this, but making home improvements isn’t the same as flipping a house.

House flippers make money by buying houses at a steep discount. They also get wholesale discounts on materials, labor and sub-contractors. If a flipper paid retail for either the property or the remodel, they would lose money. That’s a much different calculation than making improvements to your own house.

Why Major Remodels Rarely Pay Back

It’s common to hear people say “kitchens and bathrooms sell houses”. While that may be true, you have to ask: at what cost? Consider this: when you start with a functional (albeit dated) kitchen or bathroom, tear it out, haul it to the landfill (Habitat for Humanity ReStore), then purchase and install all-new everything, it’s very difficult to recoup those costs when you sell. The moment the contractor leaves, your new kitchen or bath is now…”used”. This is the same thing that happens when you drive a new car off the lot. You won’t get your full spend back at sale; you’re often lucky to recoup half.

Furthermore, no matter how proud you are of remodel, buyers will have different opinions. Regardless how good of an eye you have for design, there’s no way to know exactly what the best buyers happen to be looking for when your house goes up for sale.

The buyer who wants your house more than anyone else—the one willing to pay the absolute most, perhaps because they want to live next door to an elderly parent or for some other irreplaceable feature—isn’t going to be extra motivated by your new tile backsplash. If anything, if they happen to be a tile contractor (or just hate that pattern), they might see it as something to rip out later, not a bonus.

Buyers Love “Potential”

In my experience listing houses, people are more likely to overpay for a house with “potential”. A dated but functional kitchen or bath lets buyers imagine their own vision, and sometimes they will bid aggressively thinking they’ll DIY the updates themselves over time.

But a house heavily personalized with someone else’s expensive tastes? That can turn off buyers who don’t share your style, or force them to factor in demolition costs. For that reason, it’s often easier to sell a “fixer-upper with good bones” than it is to sell the house with an overdone custom kitchen.

Adding Square Footage Isn’t Always a Win

Added square footage sounds like an easy win, but it’s not what you think. Sites like Zillow use price-per-square-foot in their valuations, but not all square footage counts the same. See Price Per Square Foot in Real Estate is a Myth

Take garage conversions, for example. Turning your garage into living space often drops your home’s appeal and value because most buyers specifically search for homes with a garage. They want parking, storage, or a workshop. You may gain unconventional space but lose a feature many consider essential.

The same goes for comparing main-level square footage to finished basements or second-story additions. It’s not apples-to-apples. Picture five 2,000 sqft houses buyers are comparing: Four were built as true 2,000-sqft homes with proper bedrooms, flow, and natural light. The fifth was originally 1,600 sqft, plus 400 sqft added by converting the garage. Buyers will immediately view the fifth option as a smaller house with an awkward layout and nowhere to park.

How Appraisers Really Value Upgrades

When someone uses a mortgage to purchase a home, the bank usually sends an appraiser to verify the house is worth the purchase price. The appraiser finds recent sales of highly similar homes in your specific neighborhood. Once they establish a baseline from those similar sales, they make minor adjustments for differences in condition and updates.

Here is the catch: they don’t just add whatever you spent on upgrades to their base valuation. This typically means adjusting the value by only a fraction of what you actually spent on the improvements. If you’re lucky, your beautiful upgrades will push your home’s value to the higher end of the established price range for your neighborhood, but it rarely breaks the ceiling.

Don’t Just Take My Word For It

You will often hear from contractors that remodeling is a brilliant investment, but remember, they are selling you a service. It’s perfectly fine to buy the top-of-the-line stuff for your house, but realistically, it’s for your own use and enjoyment.

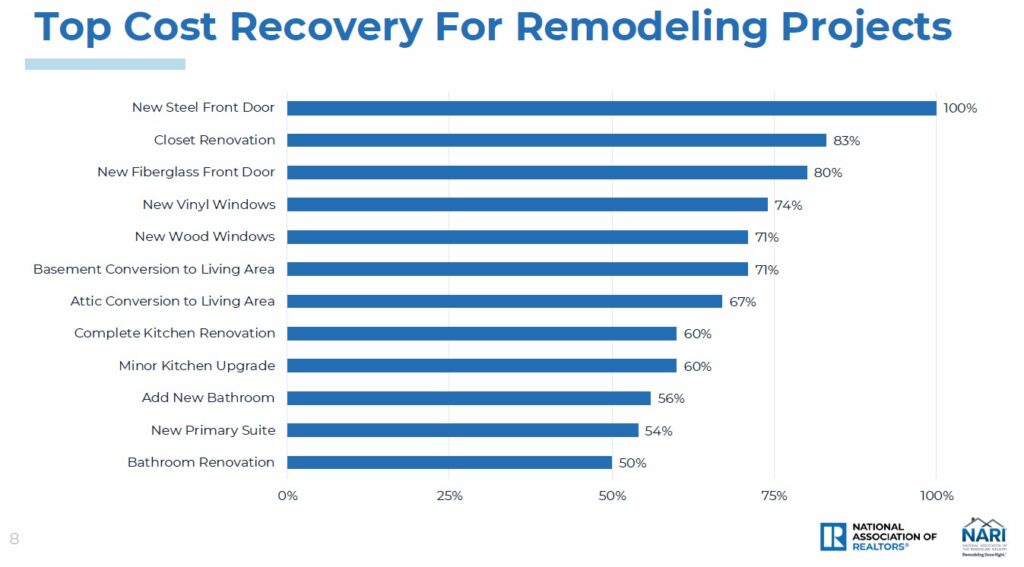

National Association of the Remodeling Industry (NARI) and National Association of REALTORS® (NAR) conduct joint studies on consumer remodeling. They consistently find that while some projects have better cost recovery than others, you generally only recoup a fraction of the cost. See the data below:

For more information on the cost-recovery aspects of home improvements, check out: Cost vs Value in Real Estate: What Matters Most?

Save Your Remodel Budget for The Next House

If you’re selling in the next few years, skip the big remodels and save that cash for your next house. Fresh paint, minor fixes, and good curb appeal are usually plenty to attract buyers without wasting money you’ll never see again.

Major upgrades are wonderful for enjoying your home now, but they rarely boost resale value enough to break even.

Bottom line: Treat improvements as lifestyle perks, not financial investments. Bank those dollars for a house you plan to keep long-term, or put them toward your ultimate dream home. Your wallet will thank you at the closing table.

Justin Rollheiser – REALTOR®

Keller Williams Realty | Diamond Partners, Inc.

13671 S Mur-Len Rd | Olathe, KS 66062

Mobile 913-800-7653

Office 913-322-5878

Comments or Questions?