Selling your home in Kansas City can be straightforward when you understand how the local market works and what buyers expect. This guide walks you through each stage of the process: preparation, pricing, marketing, negotiations, inspections, and closing. From there, you can make informed decisions, avoid common pitfalls, and sell with confidence while protecting your equity.

Benefits of Selling Real Estate in Kansas City

One of the biggest benefits of owning real estate in Kansas City is price stability. Our local economy is diverse and resilient, with no single company or industry driving things on its own. We also aren’t a major vacation or second-home market like Florida or California. This combination translates to relatively stable real estate prices. We may not see the rapid appreciation found in coastal markets, but we also don’t experience the sharp downturns. In Kansas City, timing the market matters far less than in volatile metro areas.

Who This Guide Is For?

This guide is perfect for first-time and experienced sellers in the Kansas City area who want to maximize their sale price, reduce stress, and sell within their ideal timeframe.

What You’ll Learn

This guide walks you through every step of selling a home in Kansas City, from understanding local market trends to preparing your property, pricing it correctly, hiring the right agent, navigating inspections, and getting to a smooth closing. You’ll also learn common pitfalls to avoid and how to make informed decisions that protect your equity.

- 1. Understanding the Real Estate Market

- 2. Preparing to Sell Your Home

- 3. Hiring a Real Estate Agent in Kansas City

- 4. Pricing Your Kansas City Home Strategically

- 5. Prepping Your Home for Sale

- 6. Marketing Your Kansas City Home

- 7. Legal Requirements in Kansas and Missouri

- 8. Navigating Offers and Negotiations

- 9. Inspections

- 10. Appraisal

- 11. Closing the Sale

1. Understanding the Real Estate Market

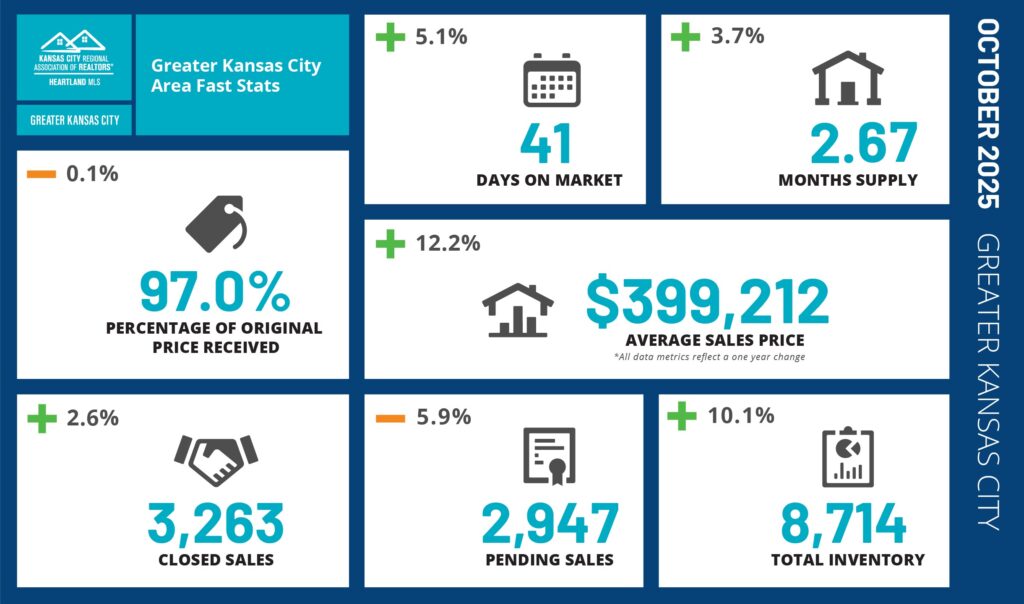

Late 2025 Snapshot

- Months of supply: 2.67 (well under the 4–6 months that defines a balanced market)

- Active listings: 8,714

- Homes sold in October: 3,263

- Inventory is up ~10% year-over-year, but we’re still in a seller’s market in most areas.

Why Local Knowledge Is Critical

Metro-wide stats only tell part of the story. Individual counties, cities, school districts, and even different streets within a particular subdivision can perform very differently. An agent who truly knows your specific sub-market is invaluable.

2. Preparing to Sell Your Home

Setting Realistic Goals

Before you call an agent or stick a sign in your yard, answer these questions:

- What is my minimum acceptable net proceeds?

- Ideally, when do I need to move?

- Am I willing to make repairs/updates, or do I want to sell strictly as-is?

Assessing Your Home’s Condition

Walk your property as if you are a prospective buyer. Do you notice things which would concern you as a buyer? Remember, issues you’ve lived with may not feel acceptable to someone seeing the home for the first time. Things to consider:

- Age/condition of roof (hail damage is common in Kansas City)

- Foundation or water issues

- Age of HVAC (maintenance records can be helpful)

- Sewer condition (repairs can be expensive; many buyers inspect this)

- Electrical panel (FPE Stab-Lok and Zinsco are frequent inspection concerns)

- Radon levels (many KC homes test high if no mitigation system is installed)

It’s a good idea to speak with your agent BEFORE making repairs or upgrades. Some items are worth addressing upfront; others will not add value based on current market conditions.

3. Hiring a Real Estate Agent in Kansas City

Do You Need A Real Estate Agent?

Maybe not! However, if you’re thinking about selling your house without an agent (aka For Sale By Owner), consider that homes sold using an agent statistically sell for 7-12% more. That means you’ll likely make more money, with less hassle, using an agent. See: “Why Sellers Regret Not Using an Agent”.

Choosing A Real Estate Agent in Kansas City

- Proven Track Record: Look for agents with experience selling homes in your area. Not all sub-markets in Kansas City are the same. And even agents with a lot of experience may not know what’s happening in your neighborhood.

- Team vs Solo Agent: Teams may sell more homes, but quantity doesn’t always equal quality. While a team have a very streamlined process, you may be dealing with a different person each time you call, or be handed from one person to the next. If that’s not your thing, consider a solo agent. You’ll get more personalized attention, but be sure they have a solid support staff.

What Are Some Red Flags?

- “Guaranteed Sale” gimmicks: When an agent promises to buy your house if it doesn’t sell, read the fine print. They’re likely offering you 20-30% less than market value. That’s a conflict of interest.

- Hiring a friend or relative with no experience: There can be pros and cons to doing business with a friend or family member. You may not want someone that close to you knowing your personal business. Regardless, you definitely want to be sure you’re working with someone with enough experience to trust them with an investment as large as your home. Getting a real estate license is relatively easy, and about 90% of agents quit within the first couple of years.

- Agent “already has buyers”: If an agent says they ‘already have buyers,’ be sure they’re willing to list your home broadly, not just show to their own clients. You need to be sure an agent you hire is working for you, not one of their pre-existing buyers. It’s possible a buyer is willing to pay top dollar without the home being listed for everyone to see, but how can you be sure? To get the highest and best offer, you generally want all the buyers to see your home, not just those who are already working with your potential agent.

4. Pricing Your Kansas City Home Strategically

How to Determine Your Home’s Value

The market value of your home is roughly whatever buyers are paying for similar homes in your immediate area. When you price your home, you need to put yourself in the buyer’s shoes. Would a willing and able buyer pay that price in today’s market? Equally important: will the appraiser agree with that price?

Avoiding Overpricing Pitfalls

Overpricing your home can be a bigger risk than it seems. If a home sits on the market too long, buyers may start to wonder if something is wrong. Imagine if you were the buyer. If there were 2 identical houses for sale, but one has been on the market for 3 months and the other one for only 3 days. Which home do you think has more demand right now? For more information on overpricing your home, check out “How Overpriced Homes Cost Sellers Money”.

Pricing Strategy

Is the market going up or down? How fast are houses selling in your area? Pricing your home is much more than simply choosing a number. A proven pricing strategy is key to ensuring you’re not leaving any money on the table.

Reacting to the Market

Once your house is finally “on the market”, it’s important to stay on top of what’s going on in the market. What else is hitting the market? How long before similar houses are getting offers? When buyers aren’t writing offers on you home, a good agent knows how to gather proper feedback from other agents and buyers who see your house. Listening to what the market is telling you will ensure you’re listing isn’t getting stale.

5. Prepping Your Home for Sale

Decluttering and Cleaning

When buyers come see your KC home, they’re essentially taking your house for a test drive. Making a good first impression is crucial. One of the most impactful things you can do before your home hits the market is getting rid of clutter and deep cleaning. Consider removing personal items such as family pictures, political messaging, etc. Reduce the clutter on areas such as counter tops and bookshelves. Buyers who tour your home need to be able to envision themselves living in your house. Keeping your décor neutral will help.

Minor Repairs with Big Returns

Focus on all the little things that don’t cost a lot and are easy to do. If you skip them, buyers may sense the house isn’t well cared for. Fix loose, crooked, or non-latching doors on the house, rooms, or cabinets. Fresh paint makes a huge difference. If you’re not a great painter, you should hire a professional. A sloppy paint job, or poor choice of color is likely worse than not painting at all. Fix anything dirty, rusty, or leaky. All of these little things add up. They’re easy fixes.

Making Updates or Improvements

One of the biggest misconceptions in real estate is that any money you put into upgrading your house is a good investment. That’s almost never true. Buyers expect the home to have solid bones, roof, and mechanicals. However, no one wants to pay full price for a used kitchen or bathroom with your design choices. Upgrading a house for your own enjoyment is great! But before you spend any money on upgrading or repairing a house you intend to sell, check out: Is Remodeling My Home A Good Investment?

6. Marketing Your Kansas City Home

Comprehensive Marketing Plan

The biggest goal in marketing your home is to compel qualified and motivated buyers to come tour your house in person, and fall in love with it. Your house’s online presence is very important. Marketing should inspire buyers to take action and come see your house ASAP. On the other hand, more isn’t always better. Crowding your listing with irrelevant or unnecessary pictures can easily dampen a buyer’s excitement. Improper marketing can actually make your house invisible to the best buyers, costing you a fortune.

How Most “Marketing” Only Benefits The Agent

One of the biggest misconceptions in real estate is that all of the marketing agents do benefits the seller. If you interview multiple agents, you’ll likely notice they spend most of their time highlighting their multi-point marketing plans, when most of their marketing is actually designed to attract business to the agent rather than the house being advertised. Less than 5% of buyers in this market buy a home as a direct result of a single piece of typical real estate marketing.

Clean Homes Show Well

Once buyers step foot into your home, the home itself is the star of the show. You’ve already done a ton of work to get your home ready to sell, but you’re not done there. Keeping your home in “show ready” condition is crucial. This can be a challenge, but it’s key in helping buyers fall in love.

7. Legal Requirements in Kansas and Missouri

Disclose, Disclose, Disclose!

In Kansas and Missouri, sellers are required by law to disclose any known defects or material facts about the property to the buyer. This can include things like foundation issues, mold, leaky basements or fire damage. It can also include any zoning or development changes occurring nearby. While sellers do not have to be experts in electrical, HVAC, roofing, plumbing, or structural issues, they do need to disclose what they know. They also need to disclose any major issues that have been repaired in the past, or any prior insurance claims.

Side note: many people assume they only have to disclose if they’re working with a real estate agent…this is false. Hoping people won’t find out is a good way to end up in court. When in doubt, always disclose!

Working with a Title Company

Obtaining title insurance is required for most new mortgages and most purchase contracts promise the buyer a clean title at closing. Before issuing title insurance, the title company will ensure the title is “clean”. This involves performing detailed title search to show any liens or defects. These issues will need to be corrected prior to the sale. If you are unsure if your title is clean, it’s a good idea to order a title search as early as possible. Some issues take time to fix and it’s better to take care of them before they derail your sale.

Want to know exactly what your home would sell for today? Get a free, no-obligation valuation here!

8. Navigating Offers and Negotiations

Evaluating Buyer Offers

After your property hits the market, and offers start rolling in, how do you determine what is important besides price? Vetting buyers is crucial. Determining the likelihood of them following through with the sale is key. Is their financing solid? Do they need to sell their house before buying yours? Is their offer too good to be true? Sometimes, unqualified buyers will try to beat out other offers by offering too much out of desperation.

Once their offer is accepted, they may try to renegotiate during inspections. It’s also possible their loan denied due to property condition or appraisal issues. How do you protect yourself from this? If the buyer is well-qualified, then what other contingencies are included in their offer?

Negotiating in Kansas City’s Market

Knowing the current market is paramount in negotiating with buyers. Despite what national news says, what really matters in real estate is what’s happening locally. Even in Kansas City, there are many different sub-markets which are different from one another. Without knowing the market, you could either be losing money or losing potential buyers.

9. Inspections

What Are Inspections?

Most buyers paying top dollar for your Kansas City home will expect an inspection period. This means that after you accept an offer, the buyer can hire a home inspector of their choice to evaluate your property. The inspection period typically lasts 10–14 days, though the inspection itself usually takes 2–3 hours, with possible follow-up visits.

What Will They Inspect?

Buyers will generally hire a whole home inspector who looks at the entire house. They may also hire specialized inspectors: HVAC, roof, radon, mold, termite, sewer, and structural. Sometimes, all inspections occur at once, other times they will add inspections based on the results of the whole house inspector.

Inspection Reports

Expect a 20-40 page report, or more. Most houses have defects, even new construction. Don’t be too nervous about inspections. Take things one step at a time, and trust your agent’s advice.

Common Deal-killers in Kansas City

- Sewer line: cracks, collapsed line, excessive root intrusion

- Basement water intrusion or foundation problems

- Hail damaged roofs, or roofs with less than 5 years’ life remaining (insurance companies are getting especially picky about this).

How to Respond to Repair Requests

Sometimes, buyers will ask to renegotiate based on inspection results. This should really only happen when there are “deal-breakers” uncovered, that were previously unknown. How much leverage you have depends on the market. Buyers have less leverage in seller’s markets and vise versa.

You aren’t required to fix anything. However, if you and the buyer can’t agree, you might have to find another buyer. An experienced agent can help you navigate any inspection issues that arise.

When repairs are absolutely necessary, it’s best to discount the price rather than having the repairs made yourself. Ideally, the buyer should make the repairs as they see fit after closing. This allows them to pick whomever they want to do the work. If anything goes wrong at that point, the sale will not be delayed. This might not be possible if the bank or insurance company finds out about any serious defects.

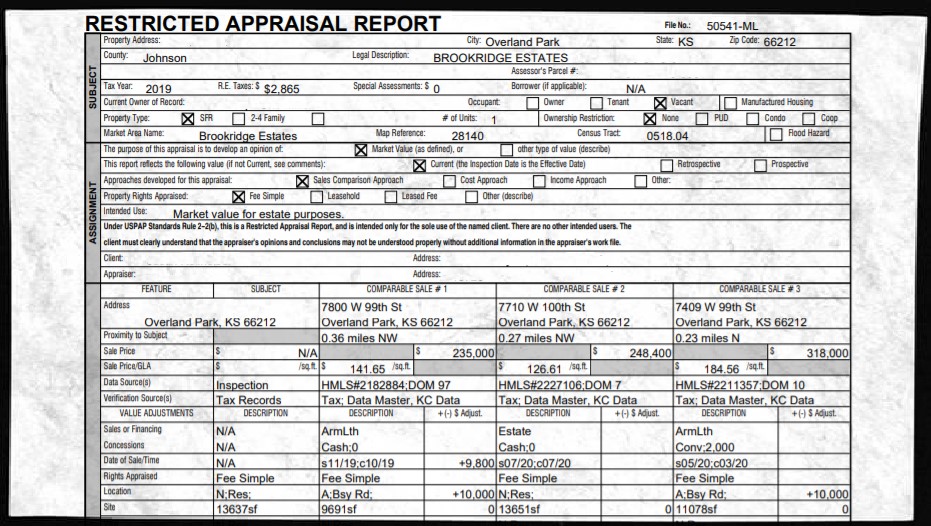

10. Appraisal

Most buyers will use a mortgage, and most banks require a 3rd party appraisal. They will send an appraiser to confirm the house is worth what the buyer is paying. The appraiser will look at recent sales of similar properties in the area to determine value.

Different loan types have different requirements. Some loan types have minimum safety standards, while other loan types just want to be sure the house isn’t falling apart. The stronger the buyer’s financial health, and the higher their down payment is, the less likely you’ll have appraisal issues.

An experienced agent can help you evaluate buyers and their offers up front to minimize appraisal hiccups.

11. Closing the Sale

Packing, Moving and Cleaning

Now it’s time to finish packing your belongings and prepare for your move. Once the house is empty, ensure it is left in ‘broom clean’ condition.

Final Walk-Through

Prior to the buyer signing their closing documents, they will likely want to take a final walk-through of the property to be sure it’s in the same condition as when inspections were completed, unless otherwise agreed.

Keep Utilities and Insurance

Until the property is officially closed, you should keep the utilities in your name and your homeowners insurance policy in place. That way, you’re protected if anything happens.

What to Expect at Closing

At this point, there’s not much left for you to do. Your agent will schedule a time for you to sign the closing documents at the title company. They will record the new deed and wire you the proceeds from the sale.

Post-Sale Steps

After the sale is complete, you can stop service of your utilities and cancel your homeowners insurance.

Final Thoughts

Selling a home is one of the biggest financial transactions you’ll ever make. In Kansas City’s stable, seller-friendly market, preparation and the right guidance make all the difference.

Ready to get started or want a no-obligation home valuation?

Feel free to reach me below!

WHAT’S MY HOME WORTH?

SEARCH HOMES FOR SALE

Justin Rollheiser – REALTOR®

Keller Williams Realty | Diamond Partners Inc

13671 S Mur-Len Rd | Olathe, KS 66062

Direct 913-800-7653

Office 913-322-5878

Comments or Questions?